Saving Money is Important to Single Income Families

Finding money saving tips for a single income family is important to making your budget work. Making the decision to have only one income can be nerve-wracking. And if you are in the lower middle-class some months can be down right nail-biting tense. But, by strategizing ways to save money you can keep a little cushion in your budget. Or increase your savings to be better prepared for the inevitable curve balls that come up.

As an Amazon Associate I earn from qualifying purchases.

If you haven’t read my first list of money-saving strategies, be sure to read them as well! That list is a great jumpstart or motivator for budgeting your month-to-month.

Let’s look at these other money saving tips for a single income family.

- Learn to do basic haircuts and skip the salon or barber shop

- Buy bulk on kitchen and household staples

- Cloth diapering babies and tots

- Make your own cleaning supplies

- Preserving food before it goes bad

- Invest in reusable food storage instead of disposable food storage

Become Your Family’s Barber to Save Money

As our boys got old enough for haircuts we quickly realized how expensive it can get taking 4 guys (our three boys plus my husband) to the salon/barber for their haircuts every 4-6 weeks. After tips, that was between $75-90! That’s over $700 average per year.

Then, if you go in for cut/color every 6 weeks…well, there are so many variables that change that cost. All that to say, that is a lot of cash for some haircuts.

By using YouTube instructional videos, investing in a good set of clippers and quality scissors, a cape (you will definitely want one), and some practice, you will be able to keep your fellas looking dapper, your girlies looking polished, and save lots of money.

BONUS MONEY SAVING TIP: Quit coloring your hair

Yes, that can be a hard pill to swallow, depending on your age. I quit coloring my hair two years ago and have fully embraced my SPARKLES! There’s no need to worry about maintenance, embarrassing demarkation lines, appointments, smelly chemicals, or anything else that comes with coloring your hair. It is LIBERATING!

There are many ways to quit coloring your hair, if you decide to go that route. Some go cold turkey, others transition with coloring techniques. And if you are looking for solidarity and encouragement, just follow #silversisters. There are so many lovely women who have embraced the grey!

Buy Bulk on Kitchen and Household Staples as a Money Saving Tip for Single Income Families

This is a money saving tip that you can work on slowly. Sometimes there isn’t always room in the budget to go buy bulk sizes of all the staples in your pantry and toiletry closet. But that is okay, you can still do this. You will also want to do a little research.

Make a list of the things you use the most in your household. Pantry items, freezer foods, and toiletries/laundry items work best for these stock-up items. Think non-perishables and shelf-stable items. For us, items like unbleached flour, sugars, baking powder, baking soda, salt, spices, canned good all make sense for me to bulk buy or stock up on during sales. We don’t have a lot of extra storage space for us to bulk buy things like toilet paper or large quantities of laundry detergent. And that is okay!

Now that you have your list, it is time to do a little price comparison. Some retailers are tricky and actually make their items cost more per ounce (or whatever measurement) in bigger quantities. You will want to compare local, semi-local, and online options to get the best deal. If you are looking for healthier alternatives I encourage you to check out Thrive Market. They offer organic and healthy items from food to cleaning products, cosmetics, pet supplies, and more. I get so many great items at excellent prices that allow me to stock up.

BONUS MONEY SAVING TIP: Create a Cash Envelope for Bulk Buying

Simple habits like setting $5-$10 aside each pay period to put in a cash envelope will allow you to plan ahead for being able to bulk buy or stock up on items when they are on sale. Or when you make that semi-local trip every few months to a different store. We budget $30-40 a month on this particular line item.

Thinking ahead and telling every dollar where to go sets your budget up for success. It also helps reduce your stress about finances because you are planning and budgeting intentionally.

Save a TON of Money by Cloth Diapering Your Baby or Toddler

I loved cloth diapering. Their fluffy bums looked so adorable in all the fun prints and colors. There was a little learning curve at first. Learning your child’s natural bathroom cues, laundering, and cloth diapering away from home. But you can totally do it! And it doesn’t have to be all or nothing.

We often would switch to disposables when traveling to visit family so we didn’t have to worry about laundering at their house. Water type, machine, detergents…they all play a role. But once you figure it out at home, it can be quite simple to manage. There are so many modern conveniences that help make it more approachable. Cloth fiber options, toilet sprayers, travel bags, etc.

Did you know that on average parents spend $1000 to $2500 on disposable diapers. And that is just in baby’s first year!!! Yowza! Imagine have two under two in diapers. For an investment of $200-300 you can cloth diaper your baby until they are potty trained, which is anywhere from 2-3.5 years old. That saves a lot of money!

Not to mention the positive environmental aspects. Cloth diapering creates less waste, uses less water, and use less raw materials to manufacture than disposables. You can read more stats and facts about it here.

Cloth diapering was one of the biggest money saving tips for our single income family.

Save Money by Making Your Own Cleaning Supplies

Did you know that you can clean your whole house with a few staple ingredients that can be mixed in various ways to create effective and powerful cleaners. Simple ingredients like vinegar, dish soap, Castile soap, rubbing alcohol, baking soda, hydrogen peroxide. Add in some amazing essential oils for scenting or boosting cleaning power and you have it all.

There are so many great recipes out there. I will work on narrowing down the BEST ones I use and make a quick reference list of recipes for you.

By making your own cleaners instead of buying the expensive, chemical-laden options that are packed with toxins, you make a choice that not only saves money for your single income family, but improves their overall health and environment.

Preserving Food Before it Goes Bad as a Money Saving Tip for Single Income Families

How many times have you got to the end of the week and see so much food in the fridge that is spoiling or you have to throw out because it didn’t get eaten. There are a few things you can do to avoid so much food waste.

Freeze produce that is getting too ripe. These can be used later in smoothies, or later in recipes like baked goods or casseroles.

Prepare leftovers as TV dinners and move them to the freezer. If you know your husband isn’t taking dinner leftover for lunch the next day, and there isn’t enough left to feed you and the kids, then put it in a freezer-safe storage solution for an easy meal later on.

Unused seasoned meat can be stored quite well in the freezer for later use.

Learning to can ingredients and meals is another great way to save money. If you come across a great price on ground beef or another of your favorite ingredients, search for a canning recipe for it. You can spend a little time on the front end by preparing and preserving these foods, and save money on the back end when you can shop your pantry at the end of a tight month.

Single Income Families Should Invest in Reusable Food Storage to Save Money

Let’s face it, buying paper and plastic products add up really fast in your weekly budget. If you have to buy paper towels, plastic baggies, plastic wrap and more, they can easily increase the overall weekly expense. Not to mention the amount of waste they create.

By investing in reusable food storage options, you can save a lot of money. And the more you were using the convenient disposable options the better and quicker you will get your return on your investment.

Start with some glass containers with locking lids. These are great for packing up those leftovers as TV dinners. We also use a ton of the quart size mason jars with the reusable lids. I already keep them for canning and preserving food, so they are a kitchen workhorse in this house.

Think of it as a Game with These Money Saving Tips

Managing a home with a single income has its challenges, but it also gives so many rewards. You learn things about yourself and what you are capable of. You look more closely at the value of things; you consider needs over wants more strategically. And when you hit your financial goals it feels REALLY good.

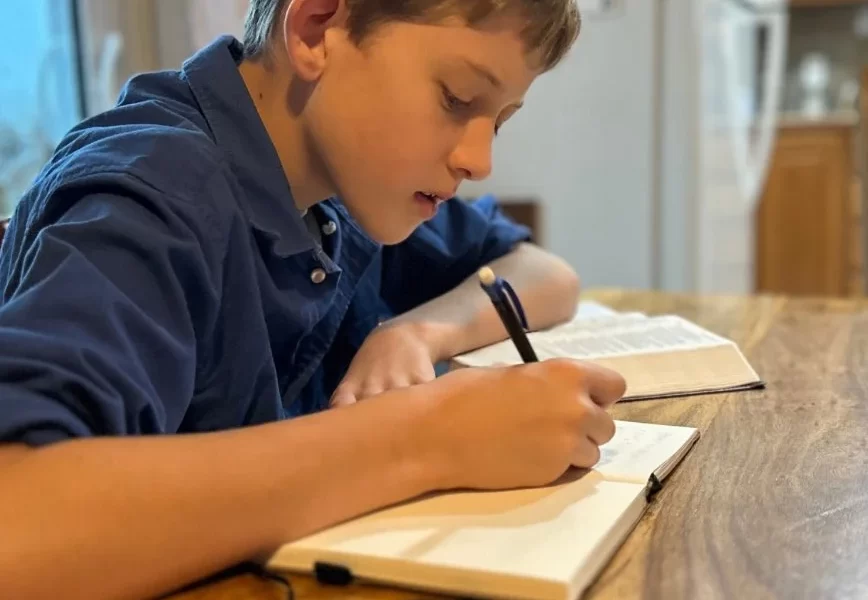

Your children watch and learn your financial habits and strategies. They learn valuable lessons of biblical stewardship and generosity. And Scripture teaches us that those who are faithful in a very little will also be faithful in much. That isn’t a prosperity gospel message, but an encouragement to steward well all that has been entrusted to you. Because it all really belongs to the Lord.

Leave a Reply