As the homemaker you are responsible for managing many aspects of the money in your home. From buying groceries, signing kids up for sports, handling doctor appointments, fixing up the home, fast growing kids needing new clothes, and the list goes on. But isn’t the finances the husband’s responsibility?

I will tell you no. The finances is a team responsibility. And you bring a lot of value to the table as manager of your home and family. So, what does that look like, and how can you glorify God in your contribution to your family’s approach to finances. Looking at Scripture and some wonderful resources of financial wisdom I am going to help you make the most of managing money as a homemaker.

As an Amazon Associate I earn from qualifying purchases.

Our Financial Story

We don’t have some remarkable story of paying off thousands of debt dollars, or winning a lottery, or anything else you can think of. We are a pretty ordinary midwestern family that lives a middle class life and middle class experiences. But that is changing.

My husband and I have really honed in our financial goals and are working diligently together to manage our money smarter and reach our financial goals, TOGETHER.

I would say it all really started about 10 years ago when we facilitated a Financial Peace University class in our church. We were not leading it because we were learning everything new, just like everyone else. But, hence, we began our journey on the Dave Ramsey 7 Baby Steps. We hit the first step, made a dent in the second step, and then life snowballed instead of our debt. We had a baby, moved across the state, sold our house (all in 3 months), rented, had another baby, bought a house (ALL GOD!!!), sold our house (again, ALL GOD!!), moved back across the state, and so on. Ha!

As an Amazon Associate I earn from qualifying purchases.

I HIGHLY recommend his book, Total Money Makeover!

The past seven years have been a slow snowball through our debt, which equated to a continual car payment. Because the car doesn’t last as long as the note and then that got rolled over into a new note. Sheesh, not good ideas there, but it happened. No sense dwelling on it and letting it get us down. And a nominal credit card balance here and there.

A New Perspective…

Until more recently, I had personally been way off the mark in my long term view of our financial future. I operated from a what you would call “live to work” mentality, instead of a “work to live” one. Meaning, we have been working our whole adult lives and really had nothing to show for it, except a decent car and a few hundred dollars in the bank. Hubs has always had a 401K, but we hadn’t prioritized our long term goals to set us both up for any kind of protection if something went sideways, or, ya know, when we get old.

Now, we have been grinding hard and hitting that second baby step with gusto. It is fun to watch that snowball roll! The Ramsey team isn’t lying when they say you get a sort of adrenaline rush as that snowball picks up steam.

We are closing in to those beautiful words, DEBT FREE, and it feels really good. Only by God’s grace, new habits, teamwork, and learning from wise financial resources are we able to get to that point.

I want to encourage you with some things we have learned along the way, resources that have helped us, and scriptural truths to anchor yourself to. As a homemaker, where you naturally help with managing the money puts you in a position to really helps your family achieve your financial goals.

Managing Money as a Team

Managing money as a homemaker starts with your spouse. You guys have to be on the same wavelength with your spending and saving goals. If you are making every effort to save money or pay off something, but your husband isn’t aware of it and keeps making purchases, you will end up fighting, feeling resentful, and not reaching any goals. Or vice versa; he is trying to save and pay off debt, but you keep spending. Then he gets resentful and frustrated.

If you aren’t on the same page with these financial goals, money is going to be a source of stress in your marriage instead of a tool to bless you and others.

@thesefullhands

You need to honestly evaluate your finances together, establish short term and long term goals, agree on any boundaries, and CONTINUE communicating all throughout the process. It isn’t a one-and-done deal. You are each other’s accountability partners as well. Financial goals cannot be successful if your are constantly going behind each other’s backs or not talking about where you are and where you want to be.

The 7 Baby Steps are a great plan. If you have never heard of the FPU course I mentioned earlier, it is a great way to build your financial literacy and get to work on your goals. But principles without practice get you no where. You are also working together to build new habits in your spending and saving game.

It all starts with a budget.

Managing Money Together With a Budget

Perhaps you have been living by generalities.

“We GENERALLY spend about $1000 per month on groceries.”

Or, “We GENERALLY go out to eat a couple times a month.”

And, “We GENERALLY only use our credit card in emergencies.”

You get the idea. You go each month with what you think is a general idea of where your cash flow stands. However, if you sat down and looked at your bank statement and added everything up, you might be surprised. Shocked, even! Things add up so fast, especially in today’s economy. Unless you are telling every dollar where to go, you really cannot get anywhere with generalities. You have to be intentional with your money and a budget is the only way to do that.

Crash Course on Making a Budget

First, gather or print off the last 3 months of your bank statements. You will need these to get a clear picture of your current spending habits.

Next, I would grab 6 different colored markers or highlighters. You can even use crayons. Go through each statement and highlight the following categories with one color each:

- Income: Any and all money deposited into your account.

- Bills: Utilities and regular necessities to keep a roof over your head, a set of wheels, and the lights on.

- Debts: Non-utility bills like car payments, credit cards, medical bills, student loans, anything financed.

- Food: Be sure to highlight ONLY where you buy groceries to feed your family, not dining out.

- Fuel: Only highlight gas purchases, not convenience items.

- Misc: Everything else falls under miscellaneous for now. Things like subscriptions, dining out, Amazon purchases, clothing, etc. We will get there in a bit.

Now that you can quickly see these basic categories, bust out the calculator. Add up each color for each statement and write those down. Are you starting to see a clearer picture on your spending habits? Sure, the bills are easy, they happen every month. But, now you can see where every other dollar is going. I was always shocked at how much all those tiny little convenience purchases add up to! Are you?

After that step, you can now scrutinize and separate your miscellaneous category. Pick an item and add up how many times it occurred the last three months. Things like fast food runs, coffee to go, impulsive Amazon purchases, etc. Try to group similar things together.

Build Your Budget

Since you have already added up your spending categories, tracked your monthly bills, and now have a clearer idea of where all you money is going, its time to put it on paper and TELL YOUR MONEY WHERE TO GO. Again, you aren’t doing this alone. Especially this step. By all means, be the initiator and bring this to your husband, but you have to do this all together. You have to be on the same page to be successful.

Using good ol’ notebook paper, Google Sheets, or a free budgeting printable, start filling in your categories; Income, Giving, Saving, Bills, Debts, Living, Personal, or whatever you want to name them. List below each category specific items. It is better to be detailed in this process, especially now that you have seen where your tendencies are.

Finally, plug in amounts. Some of these are consistent amounts and some of them are variable. Using your three months of numbers you can average them for your first month’s budget. Your goal is to get your budget to ZERO. Every dollar has a job and together you are managing the money to tell it what to do.

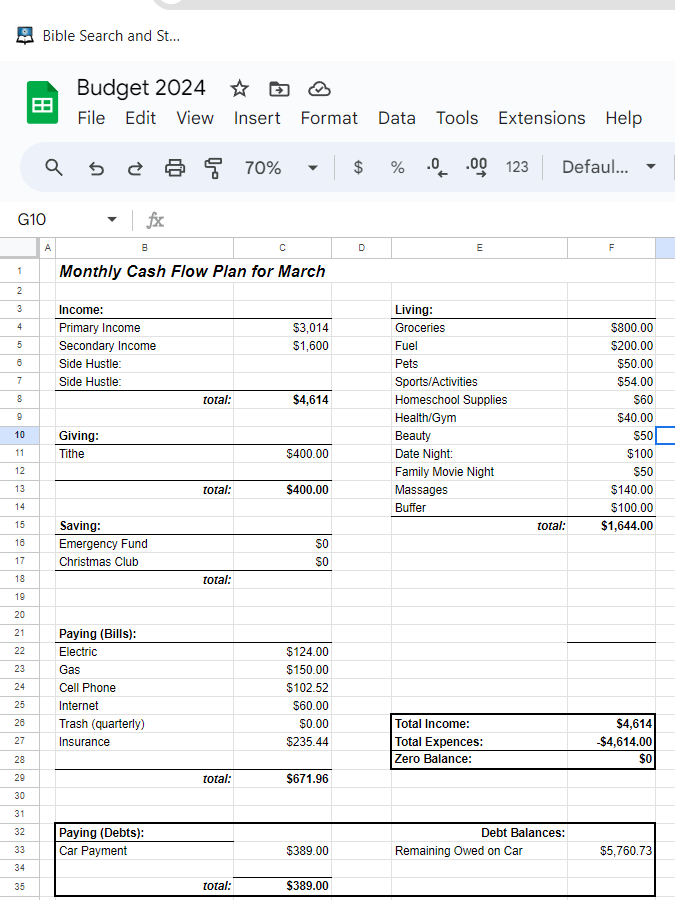

Here is a mock up of a budget…

If you have never done a budget before, BE PATIENT!! It isn’t an overnight success. It will likely take a few months of tweaking and talking for you and your husband to get the hang of things. Also, it will need adjusting through various seasons of life.

BONUS TIP:

To keep from overspending, try designating a few categories as cash only. Then, when the cash is gone, no more purchases like that. Maybe you start with a cash coffee fund, or make groceries a cash category. Working with a fixed limit can sometimes fuel your creativity! This can be especially helpful if you are trying to break old habits and build new ones. Having a cash envelope system that you can organize it all in is super helpful!

Generous to Others

Generosity isn’t just in the form of money. It starts with giving at your church, but it also looks like making extra meals that are ready to bless a family with a new baby or sick kid. Or meeting a need for someone you know, covering a meal when out to dinner, or the car behind you in the drive-thru (just because), or any other way you can think of.

To be generous and giving brings biblical joy to you life. There is something about living your life open-handedly; it’s a life that fully trusts in our sovereign God in all aspects.

Generosity toward others also shifts the focus from self. When we look for ways to be generous it becomes fun to find ways to sacrifice some of our own creature comforts. Scripture challenges us to consider others as more important than ourselves. We become vehicles of God’s goodness toward others when we remain willing to share in the blessings He has imparted to us.

Creative in Adding Income as a Homemaker

As homemakers, our mission field is our own homes and the people that we share it with. Your husband is your family’s God-given provider and works hard to meet the physical needs of your family through his labors and primary income. You are managing money as a homemaker by how that money is utilized in those physical needs. However, there may be a season, and various reasons, that you need or desire to add income to your household.

- You and your husband have debts to take care of and want to knock them out sooner.

- The economy has affected your ability to cover food costs like you want to.

- Unexpected expenses have dipped into your budget and you need to boost your income.

- You have a skill set that you want to share and make some spending money.

- The budget looks good, but some extra money would allow for a fun vacation next year.

Depending on your family’s needs, this income can come from so many different ways. It could be a long-term venture, a one-time side hustle, or somewhere in between.

Managing Money as a Resourceful Homemaker

Some ways that I have added income to our family as a stay-at-home mom over the years are:

- Running an in-home daycare

- Custom hand-lettered signs

- Garage sales and FB Marketplace sales

- Reselling used homeschool curriculum

- MLM sales with different companies

Be sure to use discernment in your search. Not every opportunity is fruitful, and could actually end up costing you more money than you end up making. Start with considering your natural gifts. Then, how much time will you need to invest. Can you work it while you take care of all your other responsibilities? Talk it over with your husband and share you excitement. He would love to support and encourage you.

Again, the need or want can come from so many different reasons. I love how the Virtuous Woman of Proverbs 31 speaks to this. It says:

She considers a field and buys it;

with the fruit of her hands she plants a vineyard. (v. 16)

and…

She perceives that her merchandise is profitable.

Her lamp does not go out at night.

19 She puts her hands to the distaff,

and her hands hold the spindle.

20 She opens her hand to the poor

and reaches out her hands to the needy. (v. 18-20)

also…

24 She makes linen garments and sells them;

she delivers sashes to the merchant. (v. 24)

27 She looks well to the ways of her household

and does not eat the bread of idleness. (v. 27)

She is managing money well in her household as a homemaker. Spending, saving, resourcefulness, creativity, and generosity; they all work together to make the most of the household income. I am inspired as I read this passage instead of intimidated. And you can be to! You may not be bringing in a 6-figure salary at home, but that is not where your value lies!

We live in a day and age when there are so many creative ways to make money. From digital products to physical, new ideas to old, physical work to passive income; the opportunity is endless.

Be Encouraged

You play a crucial role in your family. The way you manage your home naturally impacts much of your family’s finances. By staying home and being a full-time homemaker you likely save your family money in food, fuel, childcare, medical expenses, and more. When you look at yourself as a manager of your home, use some creativity and resourcefulness, apply wisdom from scripture and good financial advice, you can make an even larger impact in your family finances.

Proverbs 31 also says,

10 An excellent wife who can find?

She is far more precious than jewels.

11 The heart of her husband trusts in her,

and he will have no lack of gain.

12 She does him good, and not harm,

all the days of her life.

Your husband trusts you. Because of your diligence in managing money as a homemaker, AND MANY OTHER WAYS, he will have no lack of gain. You are blessing to your family in so many ways, bringing glory to God in how you love and serve. More precious than jewels!

Other helpful resources…

As an Amazon Associate I earn from qualifying purchases.

- Rich Dad, Poor Dad by Robert Kiyosaki

- Financial Peace Kids for teaching financial literacy to kids

- Richest Man in Babylon

- How to Turn $100 Into $1,000,000: Earn! Invest! Save!

That is awesome! The hard work is so worth it.

Thank you!

My husband and I love Dave Ramsey! He has helped us do so well in life. This is a great article.😁